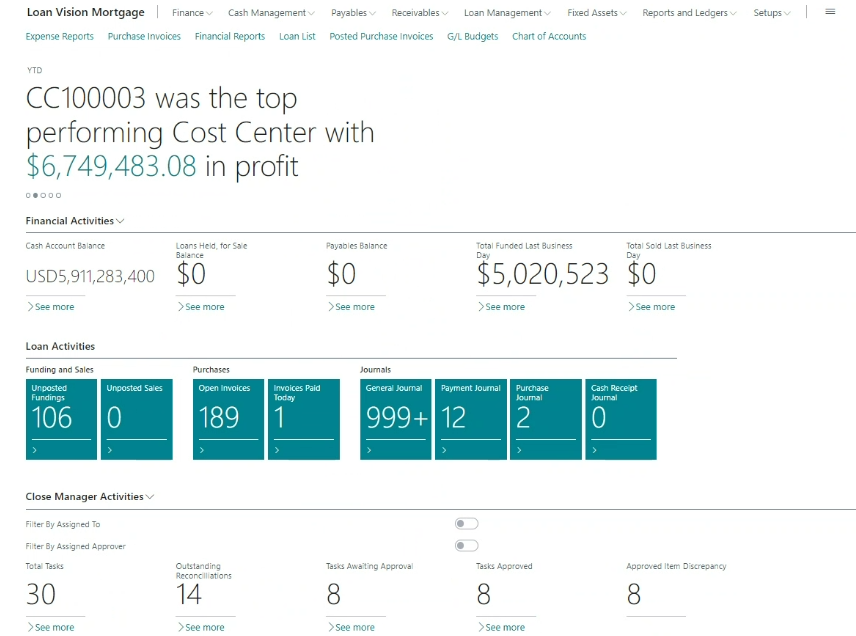

With unmatched loan-level detail, we provide you with essential KPIs giving you access to deeper level insights.

Gain peace of mind with automated compliance checks and advanced security features built on a scalable platform.

Our software reduces manual accounting tasks, improving day to day operations and enabling you to do more with less.

Designed to empower accounting teams, our software provides a range of tools from workflow automation to comprehensive analytics that enables data-driven strategies for maximizing profitability.

Loan Card – The central repository for each loan, with every piece of information stored in one place for easy reference and reporting

LOS to Ledger Automation - Custom imports that consume and validate loan-level data straight from your LOS automatically at multiple stages of a loan’s lifecycle.

Loan Funded/Sold Processing – Process and validate funded and sold data through to General Ledger for hundreds of loans in a matter of seconds.

Warehouse Line Report Consumption– Easily ingest Warehouse Line disbursement and settlement reports into the G/L without having to manipulate spreadsheets or hand key data

Loan Level Reconciliations Tools – Ensure compliance with loan level controls, lending, and compliance agreements and maximize revenue using Loan Vision’s many reconciliations tools.

Interim Servicing – Functionality that streamlines the short-term servicing of a loan, typically between the funding and sale of a loan. Produce payment request letters, receive payments, print 1098s, and export investor reports

Loan Level Reporting – Utilize prebuilt & custom loan-level reports to fully understand the true cost to originate, loan-level profitability, and much more.

General Ledger – The backbone of the system which includes a fully configurable, working chart of accounts with drill-down, filtering, reporting, and much more

Dimensions – Slice and dice data with ease using the dimension capabilities and produce financial performance reports by Channel, Branch, Loan Officer, Product Type, and more at the touch of a button.

Journals, Recurring Journals, & Deferrals – Post one-time, recurring, or deferred entries at the loan and dimension level

Close Manager – Manage and track the monthly close process with ease using the Loan Vision Close Manager. Create a checklist, assign tasks, and approve complete items directly within your financial package.

Vendor Management – Create and manage vendors within Loan Vision, allowing for efficient vendor approval, vendor document management, and reporting

Accounts Payables – Enter payables at the loan and dimension level easily with the systems import capabilities

Concur Integration – Using Concur Invoice, Expense, or both? Automatically import the approved items within Concur into the system using a push-button integration

1099 Management – Come year-end, quickly and easily produce and print 1099 reports directly from the system, while also generating the electronic file for IRS submission

Cash Management – Print checks and create ACH batches within Loan Vision, while also uploading activity from the bank for streamlined bank reconciliations

Financial Reporting – Easily create custom financial reports with multiple columns and row layouts, slice and dice by dimension, and fully drill down into the data.

Web Based Branch Reporting – Access financial performance and operational transparency via a user-friendly dashboard, enabling managers to audit expenses and track KPIs.

Basics Budgets – Prepare a financial budget, incorporate into financial reports, and analyze budget vs actual.

Ad-Hoc Reports – Leverage the power of Excel and the Loan Vision data to create ad-hoc reports which can be refreshed time and time again as needed.

Commission Profiles – Calculate complex commissions, covering conditions, tiers, teams, and more, for comprehensive financial management.

Draws Management – Automate the management of commission draws and debt directly in your General Ledger system rather than a spreadsheet.

Commission Calculation & Reporting – Quickly and easily calculate commission with the push of a button and send out commission reports directly to employees in seconds

Payroll Export – Export commissions data into Excel for loading into your payroll system of choice.

LV-PAM – Shine a light on dark areas of your business by combining LOS and Loan Vision data to bring you a comprehensive suite of solutions with advanced data modeling & predictive capabilities.

Top Tiering - Group entities into meaningful, actionable performance buckets (high performers, mid performers, and low performers) using the Pareto Principle (80/20 rule).

Company Scorecard - Give executives 360 degrees of visibility into new business volume, fallout, and associated credit box KPIs across all relevant dimensions.

Close Projections- Group all active loans within a loan stage, look back at recent history to calculate the estimated pull through, identify predicted fallout, and create a month-end close forecast.

Experience more efficient workflows while reducing manual entries. Loan Vision's robust integration feature allows for an effortless transfer of data from the leading Loan Origination and other key systems.